Even though the market is hot right now and you’re probably not worried about getting more mortgage leads, the time will come, and the market will shift.

What then?

Hopefully, you will not go back into the pattern of days ago when you relied on your marketing efforts to drive leads to your website.

What if you didn’t have to fall back into that pattern?

What if you could continue to close more leads at scale?

Surely you’re interested in learning how to keep you lead flywheel spinning from your mortgage lead generation strategy and closing more loans.

Well, we’ve put together a list of ways an AI Text Assistant can help you do just that – close more leads and keep your flywheel spinning.

Modernize your process

Obviously, I cannot see into your sales tech stack to see what solutions you have in place today, so bear with me while I make some generalizations.

You have a mortgage CRM system in place that is your single point of truth for data. You may even have a marketing automation solution in place.

When a new lead comes in from your website, it is routed to your CRM, then to your marketing suite to have an email created for the new lead.

How am I doing? Does that sound about right?

I realize there are variations to that set-up, but that is usually how it is done in the mortgage industry. Then, your lead gets a canned email to thank them for their interest or provide them a link to an asset to read more about your amazing products.

👉 read our FREE resource The Definitive Guide to Mortgage Lead Generation in 2020

It is nearly 2021 people. It is time to up your game if you want to continue to wow your leads. Everyone is sending out the same email.

Hold the phone; you call the lead during the next business day?

Well, then, that is a game-changer. Although, not really. Your competition is doing the same thing.

Plus, in this example, you still have to place all your initial phone calls.

Is that scalable?

Continue reading to see how you can modernize your process. 👇

Reduce Friction

Friction in your sales process is terrible. That sort of goes without saying, but I’m saying it anyway.

As this great post on Floify states, friction is anything that gets in the way of your customer from filling out your website form and choosing to do business with you. So, not asking them to fill out a 1003 loan application right when they get to your website.

The best way to ensure you remove the friction from your sales process is to go through the process yourself. Then, ask your co-workers, your Mom, your Dad, whomever you can get. Ask them to go through it before you have it live, so all their data is not sent directly to your CRM.

Anyway, asking their feedback through your website form, finding info on your website, etc. will provide you with greater insight into the journey.

After you turn it on, you should go back monthly, or at least quarterly, to review the analytics to see if you can find anything that jumps out to you, like a high number of users leaving one web page or starting to fill out your form but not hitting submit.

Those are signs of friction that you can now go back and improve. Here is an excellent resource if you want to go further down the rabbit hole to learn more about friction points.

Speed

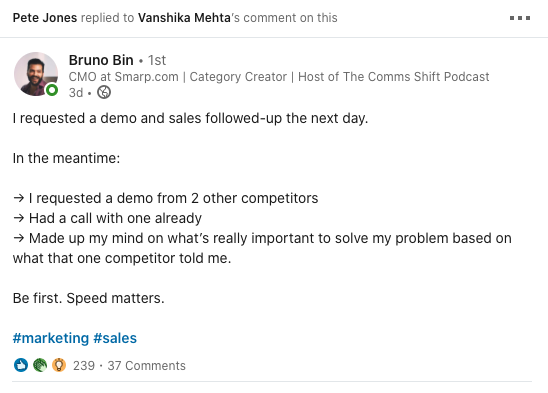

I saw a great Linkedin post the other day. Rather than boring you with my interpretation of the post, I just took a screenshot.

Yes, I know Bruno’s example paints a picture of a software sale, but it is the same in the mortgage business. Your customers are not loyal to you just because they filled out your form.

So, if you don’t want to lose out on their business, you have to get to them the fastest. I don’t mean with a canned email, as I described above.

You have to get to them with an authentic gesture.

You’re probably thinking, yeah, that sounds great, but I am freaking busy.

I wrote a fantastic post a few weeks about qualifying your mortgage refinance leads on autopilot. That post has much more detail about the following, and if you’re interested, I suggest you read it.

I know you’re freaking busy. You can’t be authentic with every one of your leads; there is just no way to do that at scale.

But there is. It is called authentic automation that includes two-way conversations with your new AI Assistant.

Oh, did I forget to introduce you to your new assistant?

Yeah, about that. Your new AI Assistant will reach out to your new lead immediately, to engage and qualify the opportunity.

We’ll get into the qualifying part next.

👉 Get more leads today, read -> The Definitive Guide to Mortgage Lead Generation in 2020

Qualify More

Old technology was great at automating the things you are likely bad at. Well, not bad. Just the things you didn’t like doing.

Like following up with tasks or doing the mundane stuff. I know I turned to automation to do a ton of things, personally and in my marketing world.

None of that automation is authentic. Sure, it can send out a canned message or remind me of a Slack I got from my boss. But, it is not helping me remember the brand of the solution when I am looking to buy.

Okay, I may not have painted a clear picture there. But, in your world. You are trying to keep your brand in front of your customers, so they’ll think of you when they are looking to sell their home or buy another.

We discussed how much I like canned messages before. I hate them. They are the worst. But, that is all we’ve had, until now.

New technology like our AI Assistant, which we spoke about in the Speed section above – if you’re skimming this post – immediately messages your lead.

After your lead faints with amazement from the immediate response, then recovers enough to return the message, the assistant then carries out a two-way qualifying conversation to understand things like:

- their timeline for making a decision

- how much they’re looking to finance,

- just the general stuff you would ask in an initial discussion.

Only, this conversation is 24/7/365. Whether you’re sleeping or in a closing. Plus, it is done at scale for all your new or old leads.

All you would have to do is show up to the scheduled appointment and close the business.

Know what’s next

Another fantastic thing about your AI Assistant is you can create all of the scripts, or you can rely on the millions of messages we’ve sent for mortgage brokers like you.

You can get signed up right away if you use the scripts we currently have in place. If you choose to do our script customization, you can change the scripts to fit your business entirely or partially.

Bringing up our scripts is not to continue with the Structurely commercial this post has become. But instead, help illustrate the opportunity to position your next steps with your lead.

One of the most significant areas of opportunity for businesses is setting the lead at ease. The best way to do that is to over-communicate the stages of your loan process. Let them know how long it will take until they hear back from you, what that will look like, etc.

Your AI Assistant can do that at scale, too.

Plus, the scale part of the process means you can stack appointments on your calendar. This is the art of setting like-minded appointments back to back to be as efficient as possible.

For example, positioning three introductory calls together, then two closing calls, etc. That way, you’re not bouncing all over the place trying to figure out what call is next.

In closing, your flywheel is just itching to spin, and it doesn’t want to stop. You have the opportunity to keep it going with a proper focus on lead follow-up and nurturing.

The follow-up will always be one of the most critical areas that will drive success for your business. If you do it well, you’ll see success. If not, well, I don’t even consider that option.