You’re in business to succeed. Generating enough new business to keep your mortgage business afloat is hard work.

There are so many factors that go into the lead generation mix you could literally pull your hair out trying to understand it all.

You know your potential customers are out there looking for answers, now.

If they have to wait for more than five minutes they’re 80% more likely to do business with your competition.

It is a sad reality, but it’s the business we’re in.

So, how do you win? How do you work smarter, not harder?

You’ve got to start by trying to understand it all.

We’ve built this guide to provide you with many of the answers you’re searching for. We’ll dig deep into the lead generation and management process to help you create a healthy, diverse, and scalable business.

Which is what we’re all after, right?

Mortgage Marketing

So, you know you have to drive leads into your mortgage lead generation funnel to produce business.

Do you know how many leads will make you successful?

You’re looking to build relationships, close business, and sell, not understand how technical Search Engine Optimization (SEO) tactics drive the most opportunity.

Would you build the foundation of a house before building the walls?

You’re not alone, starting with the foundation makes the most sense in home building like it does with building your marketing machine.

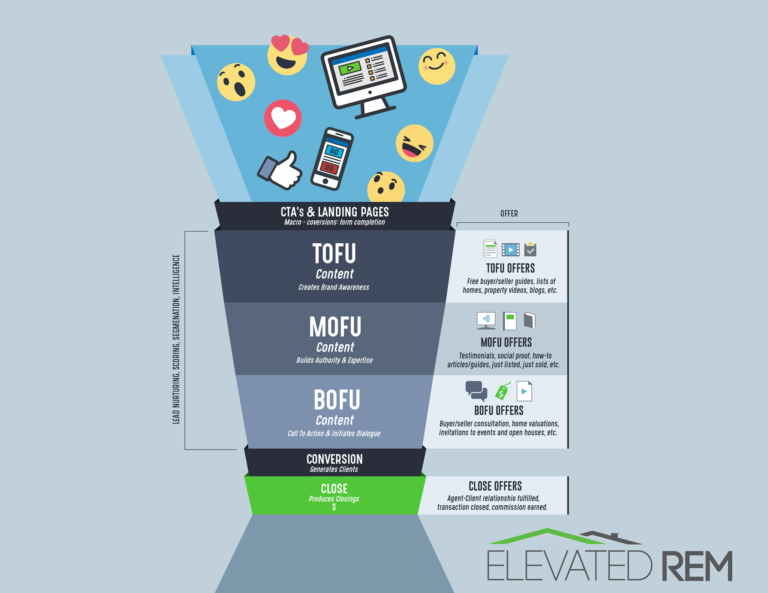

We’ll tackle the lead generation mix by addressing specific ways to drive leads into your buyer funnel, which our friends at Elevated REM visualize below. This guide will address mainly Top of Funnel (TOFU) foundational elements that will build awareness with your prospects to drive into your funnel.

Search Engine Optimization

Wouldn’t it be great if your next lead came to your website for free?

No advertising budget was spent, no design created. Just a free visit to your website from someone who has already given an indication they are interested in learning more about your solution.

That does happen, it is called Search Engine Optimization, or SEO. A solid SEO strategy will drive leads to your business, but it will take time to build.

SEO research can be complicated, but we recommend you start with the end in mind.

Generating awareness on Google starts with defining the keywords you want to rank for and you know your leads search for.

There are sources for this sort of intelligence. We leverage SEMRush and Ahrefs, but there are free tools too.

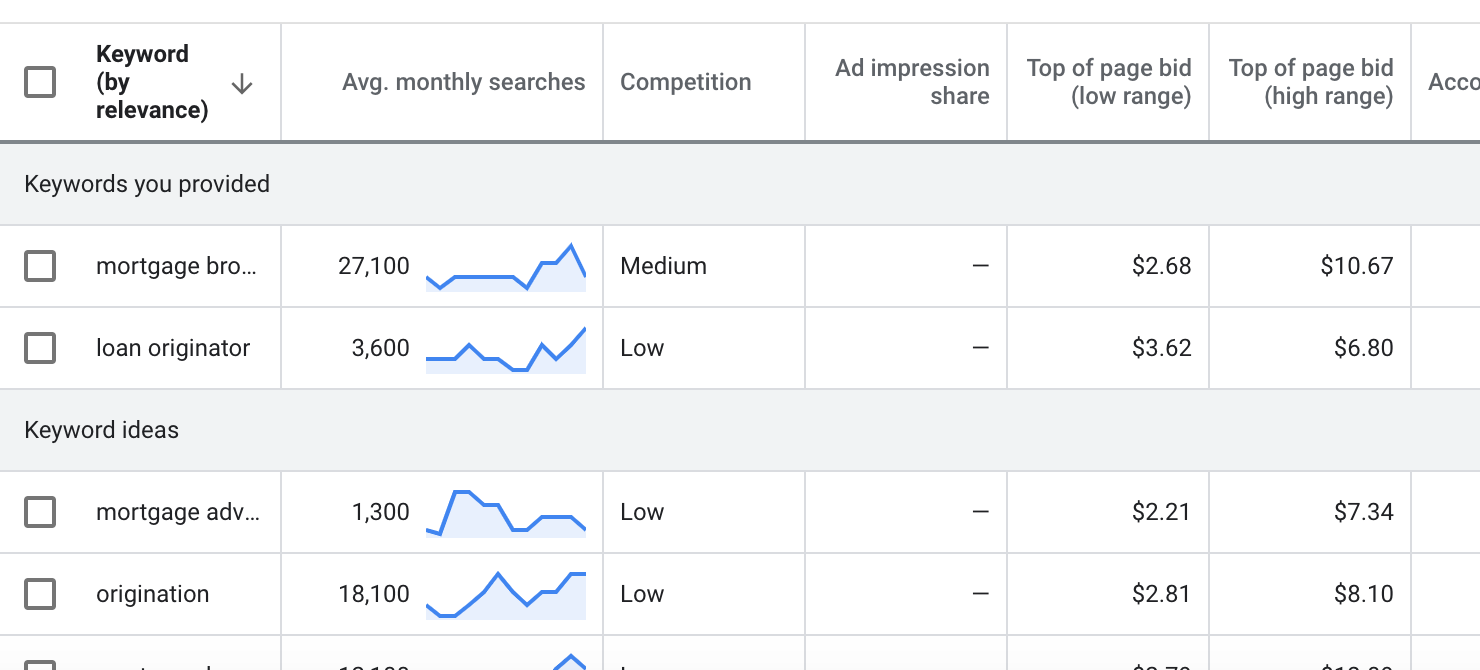

If you have a Google account, the Google Keyword Planner is a great tool to leverage to start your research. That tool is part of the Google Ads platform.

The above research from Google Ads is gold. For starters, you can see “mortgage broker” is searched 27,000 times a month (on average) but it has quite a bit of competition. “Loan originator” looks to be the better option because it has a lower search volume and lower competition.

Think of the lower search volume as a smaller mountain to climb. It will take less time and effort to get to the top, and the top of this mountain is #1 in the search rankings.

Yes, you’d love to be at the top of the 27,000 searches a month-mountain. But, that will take more time and likely more content.

Your strategy needs to include both of these terms so you can climb both mountains together. It also needs to have a mixture of high and low volume searches as well as high and low difficulties. A solid strategy also focuses on local SEO terms too.

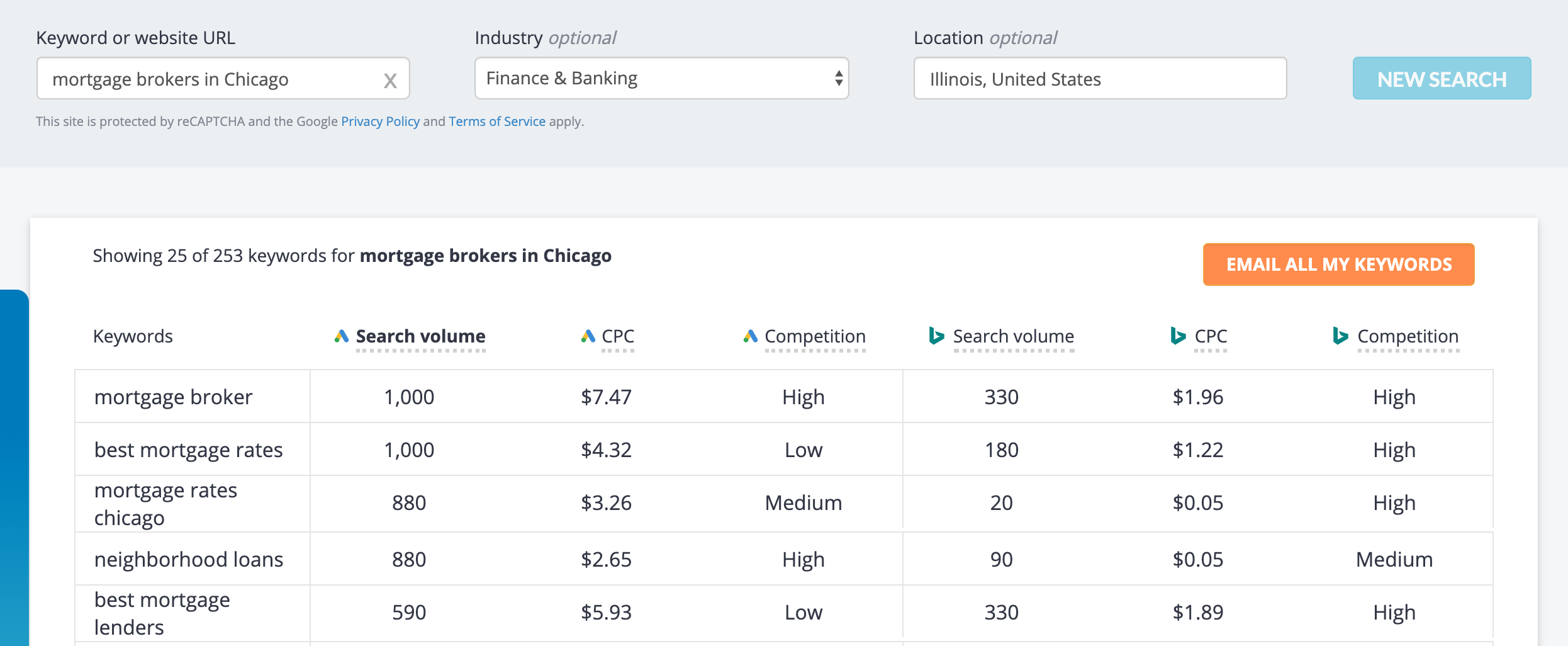

Let’s look at “mortgage brokers in Chicago.” The below image is from another free keyword solution, wordstream.com.

Here you can see the competition is still high, but there are only 1,000 searches a month. This report also shows data from Bing as well. While there is less opportunity to grab your next lead on Bing it is still a viable alternative.

It is a best practice to also incorporate short and long-tail keywords in both your local and national SEO strategies.

👉 Download our FREE ebook “Using Technology to Generate More Mortgage Leads“

Consider, not “mortgage brokers,” but “top commercial realtors” or a long search that is four or more words. These types of searches provide opportunity because they are very focused and more likely someone searching for that focused key term is the person that would benefit seeing your fantastic website.

Also, to dig a little deeper into the strategy, below are three factors that the SEO experts agree on from the more than 200 ranking factors Google uses in their algorithm.

They are:

- Dwell time – the time a visitors spends on your website – Google sees longer time spent as an indicator of value – this is where your content comes into play

- Page Depth – the number of pages a visitor goes on the site – your linking strategy

- Page Structure – the keyword you’re trying to optimize for is in your page domain, the headline (H1), and the body of the copy.

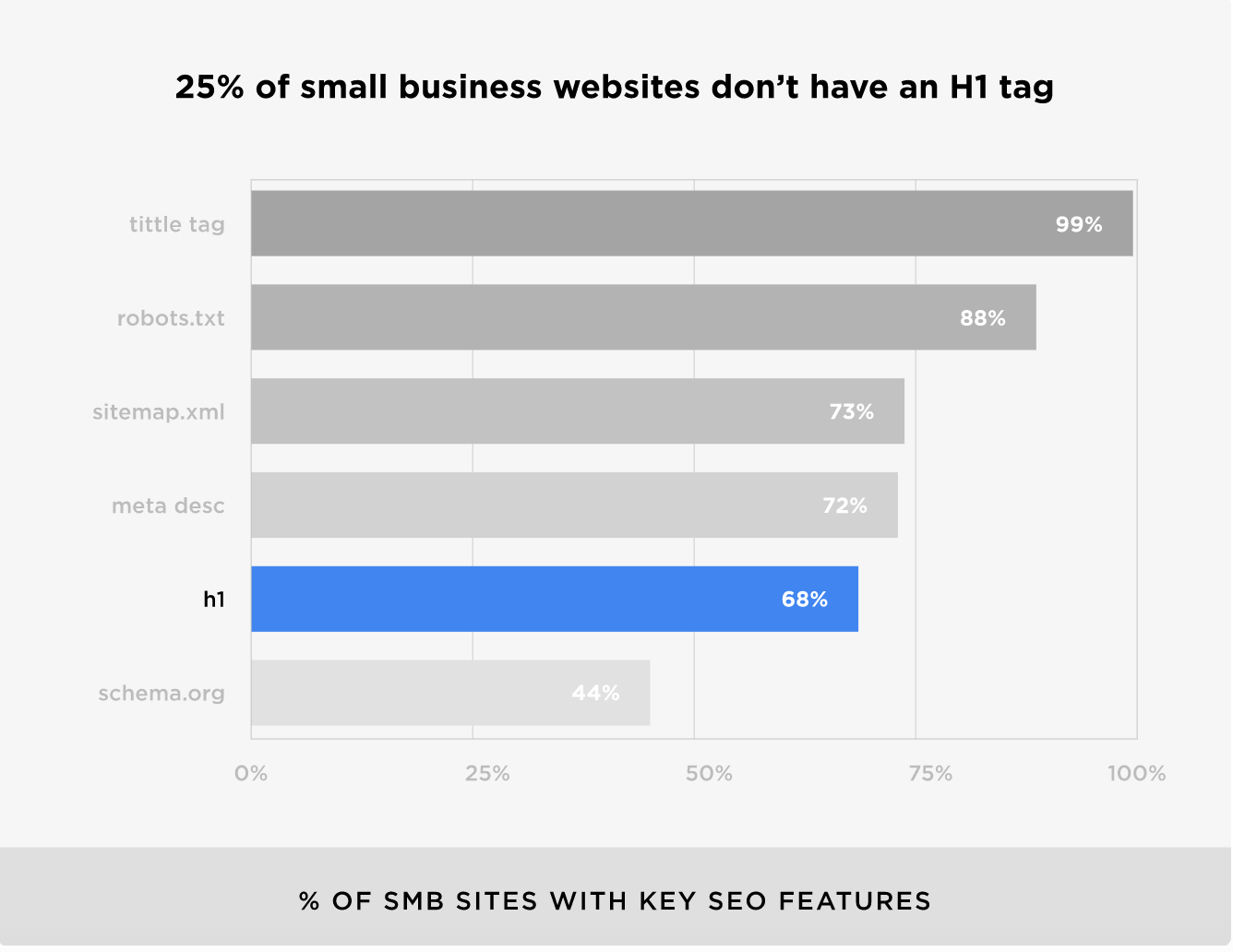

We found this stat on backlinko.com.

The rest of the elements on this image are technical in nature and complex. The H1 tag is a technical term, but it simply means your headline. This is an easy element you can address without an SEO expert on staff. Just add the keyword you’re trying to focus on your content to the headline, and the other two areas we addressed above. We’ll address how to enhance your dwell time in the next section. In order to allow your lead views more than one page on your site, you need an internal page linking strategy.

Let’s recap. In order to have your SEO strategy succeed, it needs to have the below:

Keywords

- High and low search volume keywords

- High and low competition

- Long and short keywords (mortgage broker and mortgage broker in Chicago)

- Nation and local keywords

Page structure

- Dwell time

- Page Depth

- Page Structure

Content Marketing

Awareness at the TOFU stage of your funnel is significantly important. Without it, well, there will be no leads. One way to grab leads is to have fantastic content marketing.

Would you visit a site and raise your hand to talk to their sales staff if they didn’t bring you value?

Before you write one word, though, you need to fully understand your buyer persona, which is a fictional representation of your ideal customer.

It has things like:

- Market research – to understand more about the opportunities

- Typical educational background – so you know at what level you want to write your copy

- Demographics – are they usually male or female, what age, etc.

- Common objections – the things you hear every day

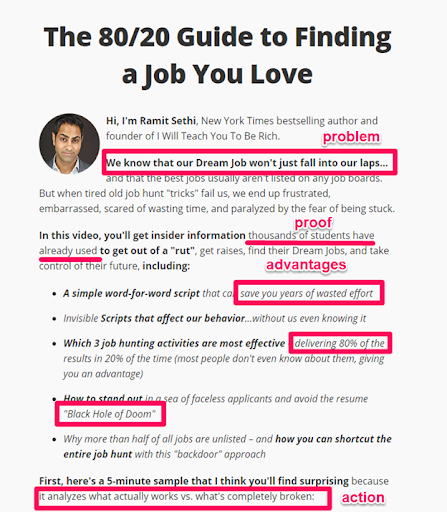

Once you have the buyer persona created, now it is time to start writing. One formula to consider when building your content asset is the PAPA strategy, that Neil Patel uses:

“Problem, Advantages (of solving the problem), Proof (that you can solve it), and Action.”

Here is an example:

This is a good framework to use when building out your content assets to ensure you maximize the opportunity.

“Compelling copy draws 7.8 times more site traffic and produces brand recall which brings higher engagement rates.”

You don’t have to write daily, but you should develop a posting pattern to keep you accountable and build value with your audience.

When you create your copy, also consider your SEO strategy and include:

- How your leads search – think like your ideal customer, what would they search for on Google

- Edutainment storytelling (education and entertainment) – write to tell a story

- Value, value, value – You have to create value by stating how you solve their problems

Write as you speak. Talk like a person, not a corporate robot. Then tell them your story and bring them value.

There are a few great copywriting to resources out there to help your content marketing. We recommend:

Digital Advertising

Did you know only 10% of people who like your social profile actually see your posts?

That means you cannot simply rely on a publishing strategy that just pushes content to your social profiles. You have to cast a wider net with intentional digital advertising.

You don’t need to spend as much money as the “big guys” do to move the needle in advertising.

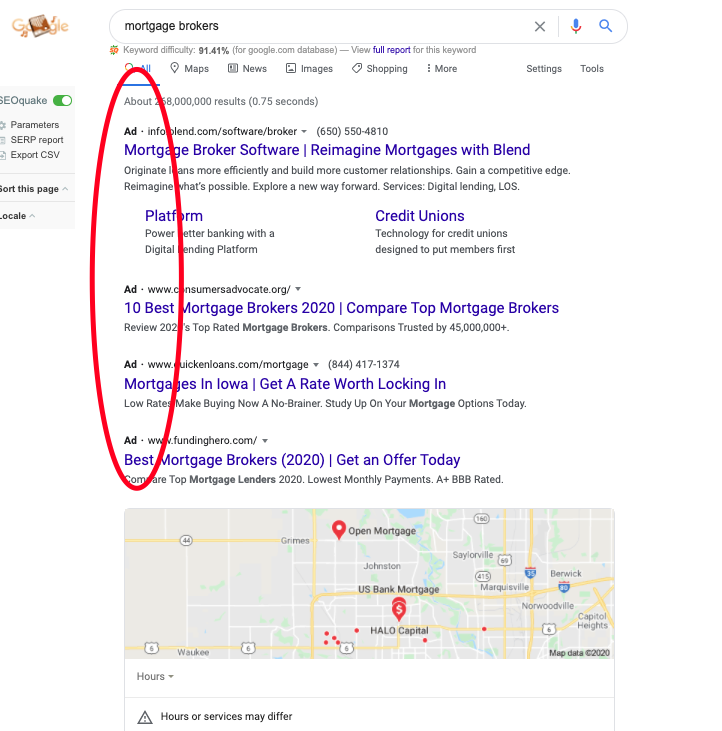

With Google Pay Per Click Ads:

- Build your keywords with the same keywords as the SEO strategy

- Consider the keywords that have a mix – some short, some long-tail (4 or more words)

- Then, find the version of the keyword that optimizes your efforts for local search.

Like we addressed above – rather than trying to win for “mortgage broker,” try to build your ad around “mortgage broker in Chicago” or “loan originator in Nantucket.”

Make sure you’ve considered the Google Quality Score concept, which simply means the keyword you’re trying to optimize for is in:

- The ad

- The domain where the ad is pointing (xyz.com/mortgage-broker)

- In the H1 (headline) on the page where the ads points

- In the body copy on the page where the ad points

Google rewards ads that are built with a good quality score with the benefit of the doubt when all things are equal to your competition. That means it is more likely you’ll get placed higher in the rankings.

Digital advertising does not just mean Google. There are great options on Facebook that our friend Travis Thom with Elevated REM shared in the webinar below.

👀 Watch the Webinar – “Stay Visible, Win Market Share & Scale Conversions“

Like Travis shared, there are different strategies to engage your leads in TOFU as well as the Middle of the Funnel (MOFU) stages of their journey.

Reviews

If you’re like us, you read reviews on websites when you’re learning about their product or solution.

There is no better way to see how reputable the company is than to read about how they serve their customers.

“88% of consumers trust online reviews as much as personal recommendations.”

Solutions like Trustpilot or Reviews.io make it easy to embed your third-party review right on your website and gain SEO value at the same time.

Then, there are sites like Google My Business, Zillow, or even Facebook where you can have your review on the platform where your lead is searching.

There is really no right strategy for the placement of your review. Just know, if you have reviews all over the place the time involved to respond and track reviews can get overwhelming.

The bottom line, your next lead expects you to have responded to your customers and apply to the feedback you’ve been given.

Video Marketing

Think of video marketing as one of the means to you Becoming The Most Well Known Mortgage Professional in Your City, as the Mortgage Coach discussed in a recent video.

One strategy to maximize your awareness in the TOFU with video is to build relationships with Realtors in the market and also win business.

To do this, ask a Realtor for their entire customer list.

You’re not just looking for their contact list to send email marketing efforts to. You’re asking for their contact list to bring significant value and make that Realtor a rock star in the process.

👉 Download our FREE bundle, “The Complete Mortgage Lead Generation Bundle ”

Use that video, or Zoom meeting, to engage the entire contact list and discuss:

- The marketplace review

- Help homebuyers be more successful

- Answer customer questions to increase pre-listing appointments

- Feature ways the Total Cost Analysis can change the way you package the mortgage

You’re the expert. You know how to work the numbers to benefit the homebuyer. Present that knowledge makes your name well-known in the market and make the Realtor your best friend. This is truly a win-win.

“54% of Consumers want to see more video content from a brand or business they support.”

Think about the “widen the net” concept we discussed in the digital marketing section above.

Now take the video you made above and package it for distribution on social media platforms or in advertisements, to widen the net and engage more prospective customers.

“88% of video marketers reported that video gives them a positive ROI”

By widening your net with this specific video example you get to use the asset twice and not recreate the wheel. Be sure to shorten the video for the advertisement to under a minute with tools like iMovie or another video editing solution.

Shorter videos perform better in advertisements and on social media. Your ad will take the user to your longer video so they can see all the value you can bring to their buying experience.

These video efforts also provide a wealth of data that you can use to build larger lists for future advertisements.

Real Estate Agent Referrals

Building trust and credibility with rock star Realtors takes time and sometimes doesn’t pay off as expected.

The ways you used to try to build relationships may not work today. Like we identified above, you’ve got to be innovative to not only stand out in the market but also work to drive business when many markets are down.

How do you do that?

Start by asking a top Realtor for the opportunity to make them a rock star with their entire client base. Then, when they accept, leverage the video concept we detailed above.

This wasn’t our idea, this came from Glenn Bill in a Mortgage Coach video, but it makes complete sense to us. Frame it as an opportunity to address their customer’s questions and concerns.

What Realtor would turn down that opportunity?

A more traditional way to drive relationships is to simply network to gain a referral partner.

This is nothing new. But, while many customers and Realtors are unable to get out you can leverage sites like Linkedin to virtually connect. Reach out to Realtors and Financial Planners to connect, but don’t just use the generic request to connect option provided by Linkedin – wow them with a nugget of significant value in an Inmail message.

A few examples of a nugget are:

- How you’ve used Total Cost Analysis to improve ratios with seller buydown options

- Understand how they bring value to their customers – then offer ideas to work together

- Build an analysis on one of their current listings

While you’re reaching out to Realtors to gain their trust you could also circle back to your customers.

60% of customer referrals occur in the first six months after the loan is closed.

There is a two-pronged approach.

- Reaching back to your customers to bring further value while simply asking for a referral

- Package the most innovative loan you wrote to use as an example the next time you get the opportunity to chat with one of the top Realtors

This allows you two ways to build value while also providing time for the other lead sources to start producing.

Building a relationship with Realtors have certain benefits:

- Delivering speed and efficiency

- Get co-marketing support (when needed)

- Keeping the transaction moving forward

- Information – keeping the customer and Realtor informed during the process

Converting Leads: Why Speed to Lead Matters

Your next lead is on your website completing the form to engage you. The digital gold is submitted and routed down your lead generation funnel.

You get the notification to respond, but you’re busy in a closing.

Do you have a process to get back to the lead?

You’re 21 times more likely to win that business if you can respond in less than 5 minutes. Every minute does count.

Luckily you have options to contact the lead. You could:

- Pick up the phone and call them

- Quickly draft an email and hit send or have an automated email queued up

- Send them a text message

You could even have engaged them before they filled out your form with the online chat option on your website. But, as we detailed above, you’re in a closing right now, you don’t really have the time to get back to the lead quickly, much less engage them in a chat on your website

What can you do?

We’ll dig into one way to answer that question in the next section of this guide. Before that though, we strongly believe you have a Plan B.

A good Plan B strategy incorporates all of the options above, and the one we’ll discuss below, to reach out to that lead because you just can’t leave anything to chance.

They could be like us and not want to actually answer phone calls.

Or, your email could sit in their Inbox until it dies.

All of these options could be true. You just don’t want one of these examples to be the reason why you lose business.

What should do you do?

Use each one of them to respond. Set up your mortgage technology to push out a response via all these channels at a cadence that makes sense. Don’t let chance cost you the speed to lead battle.

Mortgage Leads Management

As we touched on above, there is another option to consider with your speed to lead efforts that we did not discuss – to use Artificial Intelligence (AI) in your mortgage lead management process.

If you know anything about us, you know we built a conversational AI solution that responds to your leads within two minutes to engage, nurture, and qualify them.

We have many features to support why our solution works well with loan officers, mortgage brokers, and Realtors. But, don’t take our word for it.

Deloitte found that conversational AI (A bot that can carry general conversations through machine learning principles) is projected to grow 30% annually in the next few years.

A primary adoption for AI in the mortgage industry is to enhance the consumer or borrower experience, according to a Fannie Mae study.

Let’s circle back to the picture we painted above. You have an online lead that just hit submit on your website but you’re in a closing.

With a conversational AI solution, like ours, you can engage that lead via messaging within the first two minutes. The AI can also get a wealth of data about the lead and even provide you with the times they can meet so you can follow up to book the appointment, all while you’re still working on that closing. We’ve built text message scripts with input from industry experts and have had more than 1.6 million lead conversations that have helped us refine the conversation to meet your needs.

How would that work?

There are several ways we addressed in our Top 5 Ways AI Benefits Lead Management post.

Yes, responding to your lead quickly is one of the ways. The others:

- Building custom scripts to identify the questions you need to be answered and provide real-time personalization to set you apart from the competition

- Qualify leads 24/7/365 – responding to the lead on their time when they are looking for answers

- Working with more warm leads – let the AI solution qualify the opportunity so you can spend your time on the leads more likely to convert

- Nurture your leads for up to 12 months – continually position your name and brand with the lead so they’ll consider you first when the time is right

Creating a system to follow up with your leads, whether it is with our solution or not, is one of the most important elements of your lead management pipeline.

Mortgage Technology

None of the information we discussed above could be accomplished without a mortgage technology solution. Since we’re focusing on the lead generation journey, our technology approach is focused on:

- Driving traffic

- Maximizing automation

- Streamlining the lead process.

We’ve identified 42 mortgage CRM and marketing suites, loan origination platforms, and lead generation websites to help you find the right fit.

Did you know 95% of online leads convert between the 2nd and 12th contact attempts?

Do you have a plan in place to maximize your efforts for the 8th contact attempt?

We have a saying, “the best CRM is the one you use.”

👉 Read our FREE ebook “Using Technology to Generate More Mortgage Leads”

Your CRM has to be your Single Source of Truth (SSOT) from a lead management perspective. It is the home where you build the custom field to detail your buyer persona specifics or a place to list your favorite Realtor’s birthday.

“A single source of truth (SSOT) is the practice of aggregating the data from many systems within an organization to a single location.”

Many organizations have a CRM but don’t actually use it to its full potential. At full strength, your CRM needs to have a standardized data strategy to eliminate silos of data across your business. It can also integrate with other solutions to provide services specific to that area of the business. One of those integrations could be your marketing automation solution, for example.

Many marketing automation solutions power the repetitive marketing tasks that drive your lead’s journey through your funnel. What started out as just an email system now has automation solutions including landing page creation, social media integration, ad system publishing, analytics, reporting, and lead scoring.

Lead scoring is a powerful addition to your automation that is used to allow your lead the opportunity to drive their own lane with your marketing. Their lane is determined by their activity, their opens, and clicks. Their actions generate a score that allows you to focus on higher quality leads.

For instance, consider lead A:

- Filled out your website form to download an ebook

- Read two blogs

- Opened the email you sent them as a thank you and clicked on a link in the email

- Visited your website pricing page

Versus lead B:

- Opened an email

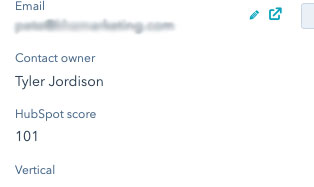

Obviously, Lead A has given you more actionable intelligence that they’re interested in you and should be considered a warm lead. We would identify each of those actions with a point score. As the lead opens, clicks, and visits their point score increases to a threshold that makes sense to have the lead off to sales. Below is an example of the Hubspot Score we use in our marketing efforts.

Even though we said above the average person gets 121+ emails a day – email is not dead. It is still a major communication form used in marketing automation solutions is email. According to Oberlo:

Lead generation websites like Zillow or Loanbright are important to diversify your lead generation strategies. These sites have a built-in reach to make sure you have the opportunity to connect with your prospect base and allow you to diversify your lead strategy. They are also a great way to widen your net and your sphere of influence (SOI).

Last but not least, loan origination software (LOS) solutions are another integration source for your CRM. If your CRM is your business’s brain, then the LOS is your business’s heart. It is where your customers go to start their loan process and where your mortgage originators, underwriters, closers, funders, and support staff go to fulfill your loans.

LOS systems today are integrated into your technology stack with access from just about anywhere, even with your mobile phone. But, most importantly, they provide your customers with online capabilities to meet their expectations and your time. It also provides you security and a lens into the customer transaction with alerts.

LOS systems are also a nice bridge should you want to utilize any sort of transaction management solution like Transactly, for example.

Now It’s Your Turn

As we said at the start of this guide, you know your leads are out there looking for knowledge to drive their decision making. You just need to be sure they find your business in their journey.

In order to find them and to create a healthy, diverse, and scalable business you need to diversify your lead sources and implement solutions to automate your lead flow. Engaging a lead is one thing, but intentionally moving them to you with their “hand raised” is another. It’s hard. But, these tactics and recommendations work for sales and marketing leaders and they work for us.

Now it is time to get out there and try these tactics. We’d encourage you to circle back and let us know how you’ve adapted your lead generation funnel as a result of this guide. Or if you have suggestions for additional ways to enhance a mortgage lead generation process, we’d love to hear them.